8th drupa Global Trends Report 2022 – Executive Summary

A lot has happened since the last one was drafted in Spring 2020! Covid pandemic, global supply chain difficulties, regional wars, trade wars, rising inflation, climate change – the list goes on. But so does life and the print industry is remarkably resilient. So strikingly, printers globally were on average slightly more confident about their companies than they were in 2019 and have strong expectations for 2023.

Printer & Suppliers sentiments…

Printer & Suppliers sentiments…

Globally in 2022 34% of the printer panel stated their company current economic condition to be ‘good’ and 16% described it as ‘poor’, a net positive balance of +18%. We can see striking variations in optimism e.g. between Europe – cautious and South/Central America or Asia – optimistic. Looking at the data by market, Packaging printers show increasing confidence, Publishing printers show a recovery from a poor result in 2019 while Commercial printers reported a small decline in confidence this year but have expectations of recovery in 2023.

Suppliers were more confident, a global net positive of +34% for 2022 and notably more positive for Europe for 2023. Whilst they were a little more cautious for the Commercial and Publishing markets for 2022 – down 4 or 5% on 2019, they have strong positive forecasts for all market sectors for 2023 (net positive balances for Publishing +36%, Commercial +38%, Packaging +48%, Functional +51%).

Between 2013 and 2019, more printers dropped prices than raised them by an average of -12% despite ever increasing paper/substrate prices. Then suddenly in 2022 there is an unprecedented positive net balance of +61% in favour of those raising rather than lowering prices. Yes, there were heavy paper/substrate price increases, but those never prompted such price increases to end customers in the past. What is going on? What is more, this pattern is global, applying to most regions and markets. It should be noted that margins remain under pressure for almost everybody – so some things stay the same.

It is a similar story for Suppliers with a +60% net increase in pricing – previously the highest was +18% in 2018. Clearly emerging from Covid, pricing behaviour has changed radically and this has implications for inflation if repeated across other industries.

Printer operational measures…

Turning to printer operational measures, one key metric that has been tracked since 2014 is the volume of print produced by the huge variety of print technology. A large drop in Sheetfed offset in Commercial was almost matched by an increase in Packaging. It is worth remembering that the first negative net balance in Commercial was only in 2018 and then also very small. The other standout features are the huge growth in Flexo for Packaging and substantial gains in Digital toner cutsheet colour and Digital inkjet rollfed colour.

One trend we would expect to have seen sustained through the pandemic is the growth of digital print as a % of total turnover. Yet this appears to have stalled globally between 2019 and 2022 – except in Commercial print which grew modestly.

Web-to-print…

There has been a steady decline in the % of printers reporting they operate a Web-to-Print/Digital storefront from a peak of only 27% in 2017 to 23% in 2019 and 20% in 2022. For Commercial printers this has dropped from 38% in 2017 to 26% in 2022, while Publishing grew to 33% this year, but Packaging fell from 15% in 2019 to 7% in 2022. We acknowledge the reduction in sample size, but the numbers are still good globally. We will just have to see if next year shows a recovery.

There has been a steady decline in the % of printers reporting they operate a Web-to-Print/Digital storefront from a peak of only 27% in 2017 to 23% in 2019 and 20% in 2022. For Commercial printers this has dropped from 38% in 2017 to 26% in 2022, while Publishing grew to 33% this year, but Packaging fell from 15% in 2019 to 7% in 2022. We acknowledge the reduction in sample size, but the numbers are still good globally. We will just have to see if next year shows a recovery.

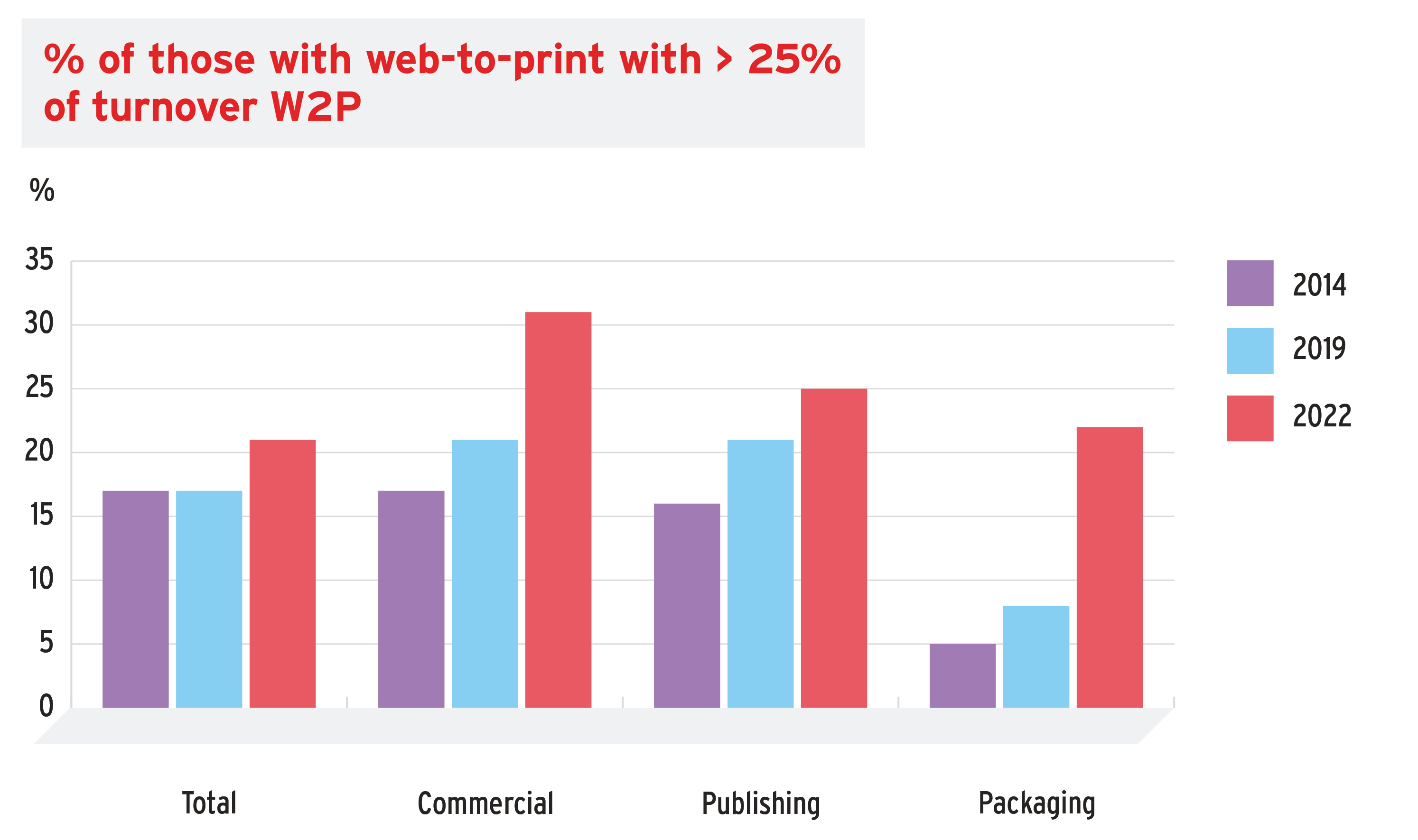

However, for those with Web-to-Print installations, the Covid period saw a substantial increase in turnover via that channel. Pre Covid this growth had stalled with no significant growth globally across all markets between 2014 and 2019 (just 17% of the panel with Web-to-Print reporting that more than 25% of turnover came that way in both years). But since then, it has shot up to 26% and the increase is across all markets.

Capital Expenditure…

Capital Expenditure…

Not surprisingly Capital expenditure has fallen back since 2019 both globally and in all markets, but the prospects for 2023 and beyond are good. Regionally all regions forecast growth next year, except Europe with a flatline forecast. Finishing equipment and print technology were by far the most popular targets.

Regarding print technology, the clear winner in 2023 will be Sheetfed offset (31%), followed by Digital toner cutsheet colour at 18% and Digital inkjet wide format and Flexo both at 17%. It is very striking that Sheetfed offset remains the favourite target in 2023, despite a clear decline in volume of print by that means in some markets. For some it is to consolidate, reduce labour and wastage, for others it is to grow capacity. What is more the popularity of Sheetfed Offset remains for all three markets.

Strikingly when asked about long term (5 year) investment plans, top came Digital Print at 62% then Automation at 52%. Conventional print was still listed as the third most important likely investment 32%, this is not to overlook the fact that the Digital technologies are growing fast if we collate the various technologies together.

As for suppliers, they reported a net positive balance +15% for Cap Ex in 2022 and a net positive of +31% in 2023. Investment forecasts for 2023 were more muted in Commercial and Publishing but strong in Packaging and Functional.

Looking at the emerging strategic challenges, both printers and suppliers have been struggling with supply chain difficulties (paper/substrates and consumables for printers and raw materials for suppliers) and they expect these to continue into 2023.

Looking at the emerging strategic challenges, both printers and suppliers have been struggling with supply chain difficulties (paper/substrates and consumables for printers and raw materials for suppliers) and they expect these to continue into 2023.

41% of printers and 33% of suppliers also reported labour shortages. Wage/salary rises have been and/or will be the result.

Environmental, Social and Governance issues are increasingly important across the globe for both printers, suppliers and their customers.

Considering short term constraints on the Print Market globally, the traditional issues dominate: Strong competition and Lack of sales/Demand – the former highlighted more by Packaging printers, the latter more by Commercial printers. Looking to the next 5 years, the impact of Digital media is highlighted by both printers and suppliers followed almost equally by Lack of specialist skills and Overcapacity in the industry.

Impact of pandemic

When we started the Trends Report series, we paid only modest attention to broader socio- economic issues. However, given the increasing impact these were having on the print market, we introduced questions on this in 2019. Given Covid and the other challenges that have come fast and furious since, this was a wise move. Globally 52% highlighted the impact of pandemics either directly or on the economy and 42% chose Economic recession in their country or region. But there were some noticeable regional variations. For example, 62% of Asian printers chose pandemic impact versus 52% globally; 58% of South/Central American printers chose Economic recession versus 42% globally; and 32% of European printers chose regional physical wars versus 21% globally. And there was a clear majority (59%) that thought socio-economic pressures were either more important than or of equal importance to market pressures.

In conclusion we were encouraged by the broadly positive outlook that printers and suppliers had both of trading in 2022 and the prospects for 2023. Indeed, perhaps the single most striking result of the survey was that globally the Barometer of Economic Confidence was slightly higher in 2022 than in 2019 before Covid struck. Then again, most regions and markets forecast better trading in 2023. This was not universal and there are strong headwinds to make things more difficult – some global, some regional.

In conclusion we were encouraged by the broadly positive outlook that printers and suppliers had both of trading in 2022 and the prospects for 2023. Indeed, perhaps the single most striking result of the survey was that globally the Barometer of Economic Confidence was slightly higher in 2022 than in 2019 before Covid struck. Then again, most regions and markets forecast better trading in 2023. This was not universal and there are strong headwinds to make things more difficult – some global, some regional.

Clearly investment fell during the Covid pandemic and companies have taken time to recover. Nevertheless, printers and suppliers report a determination to grow their businesses, investing as necessary, starting in 2023. As there are few signs that market and broader economic pressures will lessen, this is just as well. For only those companies who invest wisely, bring their costs down by raising productivity, diversify and innovate and invest in their team, will prosper. This is well summarised in a quote from a printer in Portugal.

“Looking for the biggest opportunity, my company must be alert, be patient and look for new demands… The Covid pandemic, and the Russia/ Ukraine war will bring new disruptions in market, but equally may create new opportunities. [These] could be found in markets where innovation and rehabilitation [reform] could happen. For that, my company will look essentially for digital operations… (labelling, digital printing – wide format and medium format).” – Commercial, Packaging and Functional printer, Portugal.

Comments are closed.